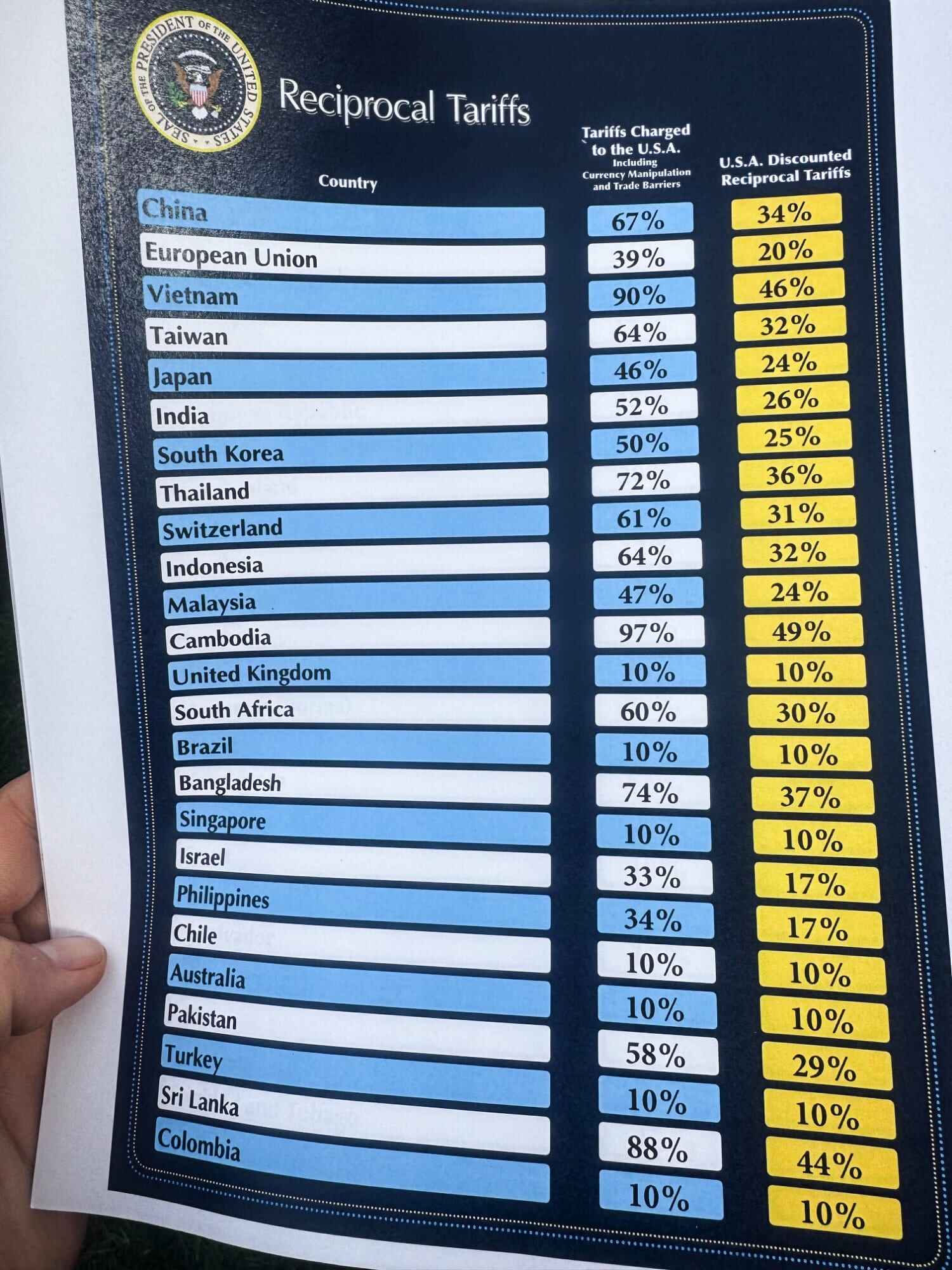

As we previously reported, President Donald Trump made headlines again by slapping new tariffs on just about every country out there.

It didn’t take long for the stock market to dip and for global trade tensions to heat up. With a possible trade war and fears of a recession growing, consumer habits are already starting to shift and those changes might hit the skateboarding industry in some very real ways.

Let’s break it down. When tariffs go up, they act like a tax on imported goods. So if you’re a distributor or a shop importing decks, trucks, or apparel, you're likely going to pay more just to get stuff into the country.

That higher cost often trickles down to the consumer. In other words: stuff gets more expensive.

In Trump’s list of new tariffs, three countries jump out for people in the skate world - China, Mexico and Canada. The U.S. now has a 125% tariff on Chinese goods and a 25% tariff on goods from Mexico and Canada.

That matters a lot, because China is one of the biggest players when it comes to manufacturing. Everything from skate shoes to shop decks and hardware.

What This Means for Skate Shops and Manufacturers

For local skate shops, this could mean fewer affordable options on the wall. Most independent shops don’t carry massive inventories, and many rely on steady shipments of goods from overseas.

If the cost of importing decks or apparel jumps significantly, those shops either eat the cost (and risk going under) or raise prices (and risk losing customers). Neither option is great.

Skate brands that rely on outsourced manufacturing could also be caught in the middle. Most woodshops already run on tight margins, especially those using Canadian maple but still relying on international labor or equipment.

A spike in costs could slow down board production or force changes in materials - possibly affecting quality or consistency.

Even the companies that manufacture boards domestically might feel the squeeze. Many of them import veneer, glues, or finishing tools.

If prices go up for those raw materials, it'll affect production costs across the board. Meanwhile, smaller brands like startups may struggle to stay afloat if they can’t find ways to reduce overhead or pivot quickly.

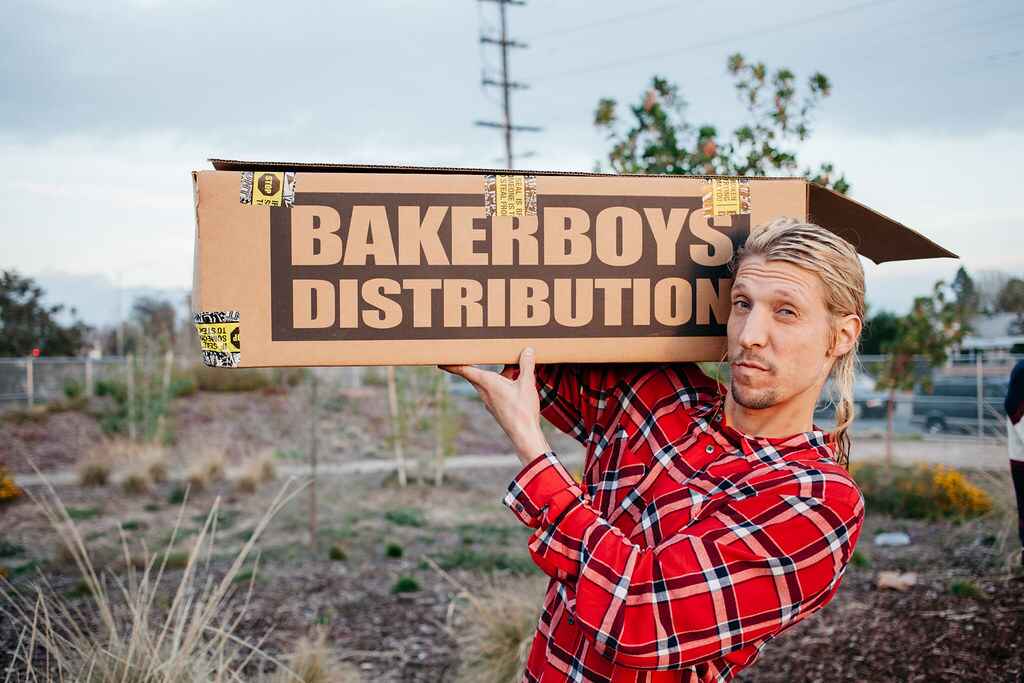

Distributors and Larger Brands: Who Can Ride It Out?

Larger distributors and legacy brands with deeper pockets will probably find ways to ride it out.

They might already have long-term contracts in place or enough inventory to float through a rough patch. Some might even see this as an opportunity. If smaller brands drop out or cut back, it could clear room on shop walls or online marketplaces.

This could lead to a bit of consolidation. In other words, fewer players with more control. Brands that can afford to sit on product or offer flexible pricing to shops will be in a better position to survive a slowdown, while the smaller operations will be left making tough choices: cut margins, change suppliers, or pause production altogether.

What's Up With the Skate Apparel Side of Things?

It’s not just boards and trucks on the line. Apparel has become a big part of the skate economy. With tariffs on Chinese goods, the price of T-shirts, hoodies, pants, and even accessories could climb fast. And when times are tight, customers tend to cut back on non-essentials - especially premium-priced skatewear.

Just like in fashion, the more casual, thrift-inspired side of skate apparel might actually gain ground. As people look for cheaper ways to rep their favorite brands or skate crews, secondhand gear, small-run items, or even DIY gear could start to gain traction. Local print shops, garage brands, and clothing resale pages on Instagram might become more appealing alternatives to $100 hoodies or logo-heavy gear.

What Skaters Are Likely to Do

Skaters have always found ways to keep rolling, no matter the economy. If prices rise and wallets tighten, we might see more deck repairs, more board swaps, and more secondhand setups showing up at the park. It’s also possible that kids start grabbing blanks instead of branded boards, or holding onto a deck a little longer than they normally would.

This sort of adjustment isn’t new. Skateboarding’s always had an underground, DIY side that thrives when things get lean. But that doesn’t mean shops, woodshops, and manufacturers won’t feel the pinch. Especially those just trying to stay in business, not necessarily get rich.

Final Thoughts

While a potential recession and these new tariffs aren’t great news for the skateboarding industry, they’re not the end of the road either.

The companies and shops that can adapt - whether that means sourcing differently, leaning into community, or tightening operations will have a better chance of making it through.

If nothing else, it might push the industry to get a little more creative. And if there’s one thing skateboarding’s always had, it’s creativity.